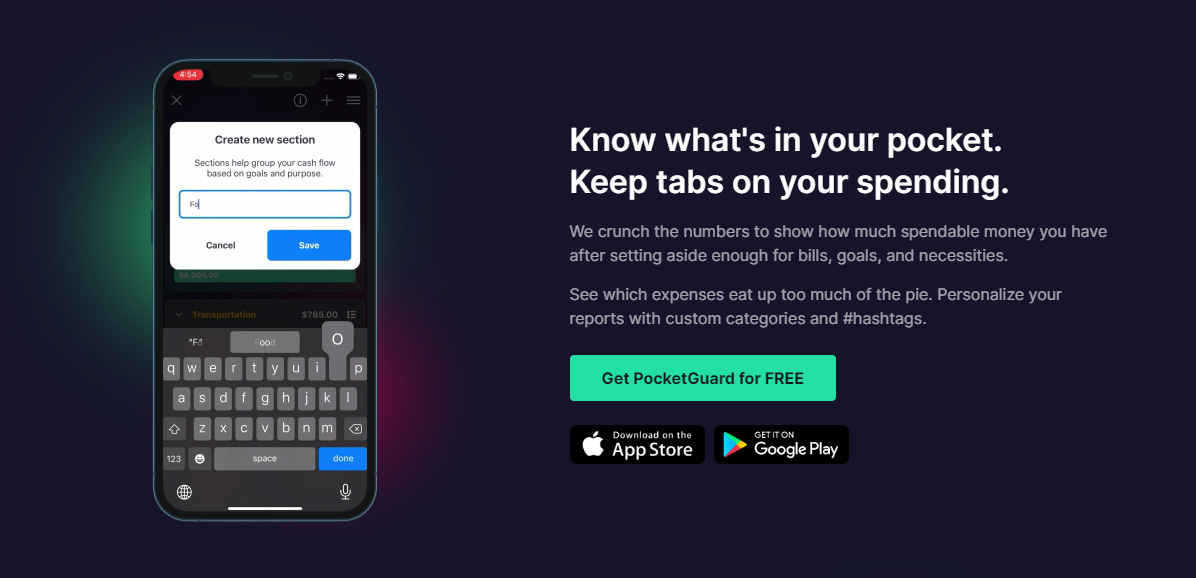

PocketGuard is a personal finance app that helps individuals manage their money and track their spending. It connects to users' bank accounts and credit cards to automatically categorize transactions and provide a clear overview of their finances. The app allows users to set budget goals, track expenses, and receive alerts for bills, fees, and other financial activities. PocketGuard also offers insights and recommendations to help users save money, avoid unnecessary fees, and optimize their spending habits.

PocketGuard is a personal finance app that helps individuals manage their money, track their spending, and stay on top of their financial goals. It connects to users’ bank accounts, credit cards, loans, and other financial accounts to provide a comprehensive view of their finances in one place.

With PocketGuard, users can categorize their transactions, set budgets, and receive alerts when they are close to exceeding their budget or have unusual spending patterns. The app also provides insights and recommendations on how users can save money, reduce their debt, and improve their financial health.

PocketGuard uses bank-level security and encryption to ensure the safety of users’ financial information, and it does not store users’ login credentials or personal information. The app is available for both iOS and Android devices, and it offers a free version with basic features as well as a paid subscription option for more advanced features.

Overall, PocketGuard is designed to help individuals take control of their finances and make smarter financial decisions.