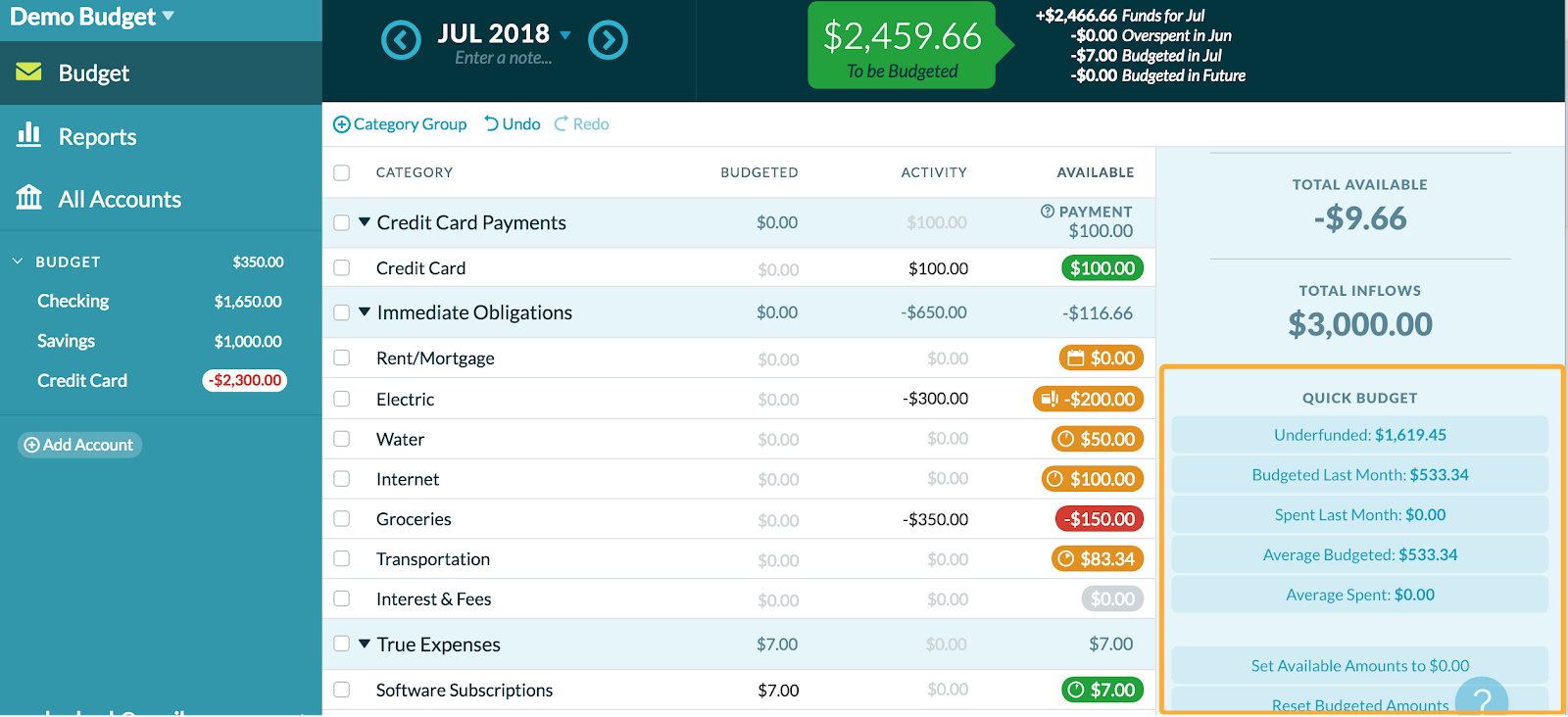

You Need a Budget (YNAB) is a paid budgeting app that uses the zero-based budgeting method. This method involves assigning every dollar in your budget a specific purpose. YNAB is known for its easy-to-use interface and helpful customer support.

“You Need a Budget” (often abbreviated as YNAB) is a personal budgeting software that aims to help users take control of their finances. Unlike some other budgeting tools that merely track expenses, YNAB emphasizes a proactive approach to budgeting. Here are the key elements and features of YNAB:

- Rule-Based System: YNAB operates on four primary rules:

- Give Every Dollar a Job: Assign every dollar you have to a specific category or purpose, ensuring you’re intentional about how you spend or save.

- Embrace Your True Expenses: Break down larger, infrequent expenses into smaller, more manageable monthly amounts, so you’re prepared when they come due.

- Roll with the Punches: Adjust your budget as needed. If you overspend in one category, cover it by moving money from another category.

- Age Your Money: Aim to spend money that you earned at least a month ago, fostering a cycle of living on last month’s income, which can help prevent living paycheck to paycheck.

- Proactive Budgeting: Instead of merely tracking expenses after they happen, YNAB encourages users to actively allocate funds to specific categories in advance, promoting more thoughtful spending.

- Account Aggregation: Like many other budgeting tools, YNAB allows you to link bank accounts and credit cards, giving you a centralized view of your finances.

- Goal Tracking: YNAB lets users set and track financial goals, whether it’s saving for a vacation or paying down debt.

- Reports: The software provides detailed reports to give insights into income, expenses, net worth, and other aspects of your financial life.

- Education: YNAB offers a range of educational resources, including tutorials, webinars, and blog posts to help users better understand personal finance and get the most out of the software.

- Cost: YNAB was not a free software. It came with a monthly or annual subscription fee. However, many users found the value it provided—especially in terms of helping them save money—well worth the cost.

- Cross-Platform: YNAB is available on various platforms, including web browsers, iOS, and Android, allowing users to manage their budgets from virtually anywhere.

- Community: The YNAB community is known for being active and supportive. Forums, social media groups, and other platforms provide spaces for users to share tips, success stories, and seek advice.

Overall, YNAB is a great budgeting app for people who are serious about getting control of their finances. It’s easy to use, has a helpful customer support team, and uses the zero-based budgeting method, which is a proven way to get your finances in order. However, it does cost money, and there is a bit of a learning curve. If you’re looking for a free budgeting app, YNAB is not the right choice for you. However, if you’re willing to invest in your financial future, YNAB is a great option.