Here are some of the best budgeting apps in 2023, along with their key features:

Best Budgeting Apps Reviewed

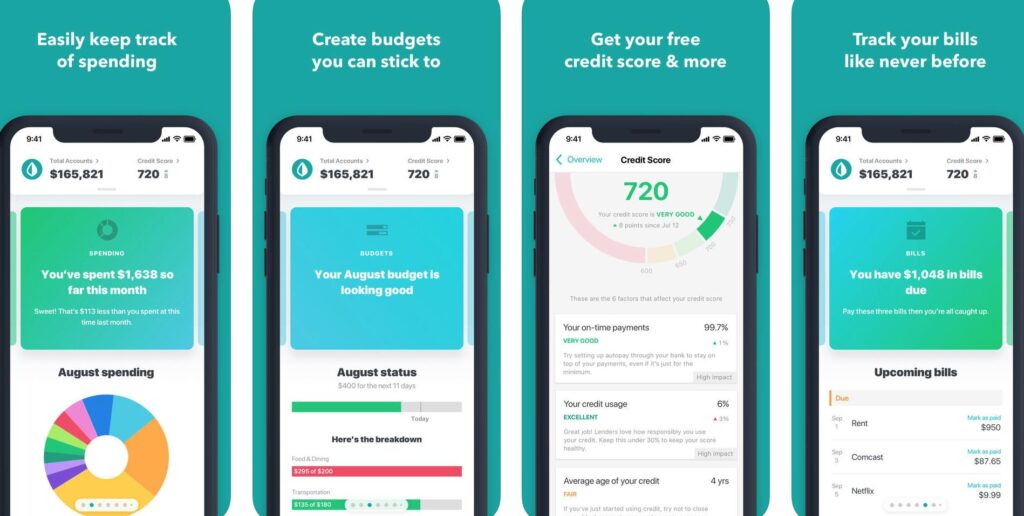

Mint

Mint is a free budgeting app, developed by Intuit, the same company behind well-known products like QuickBooks and TurboTax. It syncs with your bank accounts and credit cards to track your spending. It also offers bill pay reminders, credit score monitoring, and investment tracking.

Over the years, Mint has received various updates and new features, so the current state of the app might have additional functionalities or changes. It’s always a good idea to check their official website or app store listings for the most up-to-date information.

Best Alternatives to Mint

Here are some alternatives to Mint:

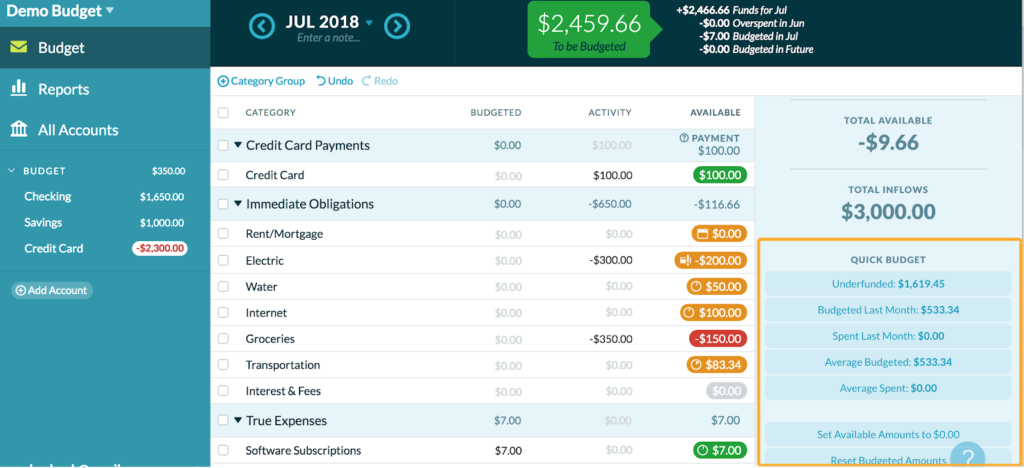

- You Need a Budget (YNAB): YNAB is a paid budgeting app that uses the zero-based budgeting method. It’s known for its easy-to-use interface and helpful customer support.

- Goodbudget: Goodbudget is a free budgeting app that uses the envelope budgeting method. It’s a good option for people who want to budget with cash or who want a more hands-on budgeting experience.

- PocketGuard: PocketGuard is a free budgeting app that uses a combination of tracking and budgeting features. It tracks your spending and helps you create a budget based on your income and expenses. PocketGuard also offers bill pay reminders and helps you find ways to save money.

- EveryDollar: EveryDollar is a free budgeting app that uses the zero-based budgeting method. It’s similar to YNAB, but it’s less expensive and has a simpler interface. EveryDollar is a good option for people who are new to budgeting or who want a budget app that’s easy to use.

You Need a Budget (YNAB)

Over the years, YNAB has garnered a dedicated user base due to its effectiveness in helping many individuals and families take control of their finances and reduce debt. As with any software, updates and changes can occur, so it’s good to check their official website for the most up-to-date information.

Best Alternatives to YNAB:

- Mint: Mint is a free budgeting app that syncs with your bank accounts and credit cards to track your spending. It also offers bill pay reminders, credit score monitoring, and investment tracking.

- EveryDollar: EveryDollar is a free budgeting app that uses the zero-based budgeting method. It’s similar to YNAB, but it’s less expensive and has a simpler interface. EveryDollar is a good option for people who are new to budgeting or who want a budget app that’s easy to use.

- Goodbudget: Goodbudget is a free budgeting app that uses the envelope budgeting method. It’s a good option for people who want to budget with cash or who want a more hands-on budgeting experience.

- PocketGuard: PocketGuard is a free budgeting app that uses a combination of tracking and budgeting features. It tracks your spending and helps you create a budget based on your income and expenses. PocketGuard also offers bill pay reminders and helps you find ways to save money.

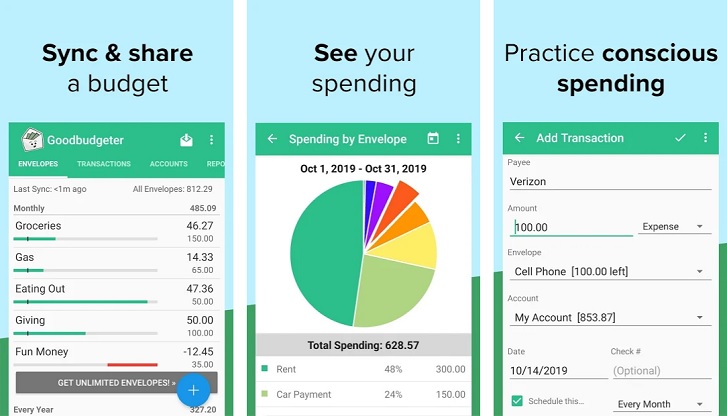

Goodbudget

Goodbudget is a free budgeting app that uses the envelope budgeting method. This method involves dividing your money into physical or digital envelopes, each for a different budget category. Goodbudget is a good option for people who want to budget with cash or who want a more hands-on budgeting experience.

Goodbudget is a personal budgeting app that utilizes the envelope budgeting method, a tried-and-true system where money is allocated into “envelopes” for different spending categories. Here’s a breakdown of Goodbudget and its features as of September 2021:

- Envelope Budgeting: Goodbudget’s main feature revolves around the envelope system. You allocate a certain amount of money to each envelope (e.g., groceries, rent, entertainment), and as you spend in each category, you draw from the corresponding envelope. This helps you visualize and control your spending.

- Digital and Physical Transactions: The app allows you to manually record transactions, which is great for cash expenses or if you prefer not to connect your bank accounts. However, it’s worth noting that unlike some other apps, Goodbudget does not automatically sync with your bank.

- Cross-Platform: Goodbudget is available on both Android and iOS, and it also has a web version. This accessibility makes it easy for users to check and manage their envelopes from various devices.

- Debt Tracking: In addition to regular budgeting envelopes, Goodbudget provides features to help users track and pay down their debts.

- Shared Budgeting: One standout feature is the ability for households to share and sync their budget across multiple devices. This makes it easier for couples or roommates to manage shared expenses and maintain a cohesive financial plan.

- Reports and Insights: Goodbudget provides reports to help users understand their spending habits, savings progress, and more.

- Free and Paid Versions: The app offers a free version with a limited number of regular and annual envelopes. For those needing more envelopes or additional features, there’s a subscription-based version called Goodbudget Plus.

- Backup and Sync: Your data is regularly backed up, and if you use multiple devices, your budget data can be synced across all of them.

- Education: Goodbudget’s website offers articles, how-to guides, and videos to help users get the most out of the app and better understand the envelope budgeting system.

Goodbudget is particularly suitable for individuals and families who appreciate the clarity of the envelope system but want a digital version rather than dealing with physical cash and envelopes. Its manual transaction entry can be seen as a pro or con, depending on user preference. Some appreciate the mindfulness that comes with manual entry, while others might miss the convenience of automatic syncing with bank accounts.

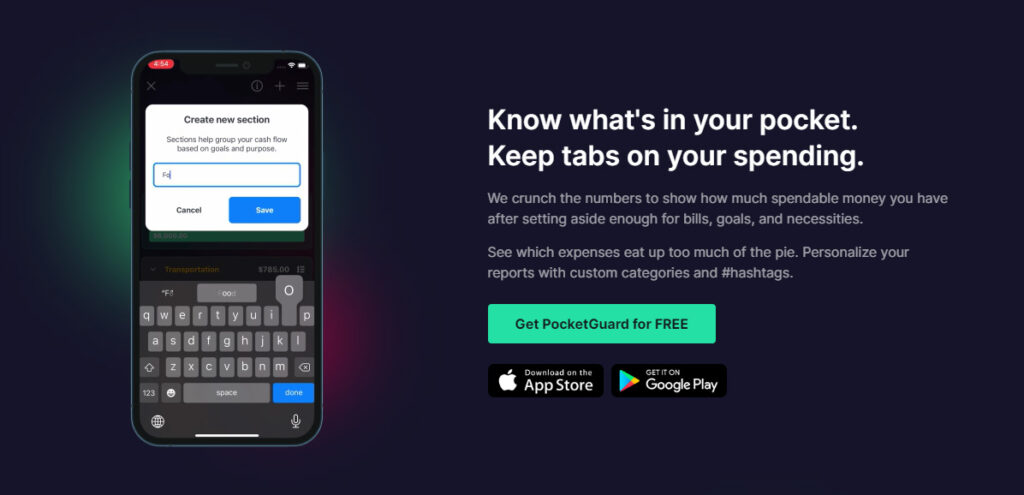

PocketGuard

PocketGuard is a budgeting app that helps you track your income, expenses, and debt. It syncs with your bank and credit accounts to automatically import your transactions, so you can see where your money is going in real time. PocketGuard also allows you to create budgets and set spending limits, so you can stay on track with your financial goals.

Here are some of the features of PocketGuard:

- Bank and credit account syncing: PocketGuard automatically imports your transactions from your bank and credit accounts, so you can see where your money is going in real time.

- Budgeting: PocketGuard allows you to create budgets and set spending limits for different categories, such as groceries, transportation, and entertainment.

- Spending alerts: PocketGuard sends you alerts when you’re approaching your spending limits, so you can avoid overspending.

- Debt tracking: PocketGuard helps you track your debt payments and interest rates, so you can get out of debt faster.

- Goals: PocketGuard allows you to set financial goals, such as saving for a down payment on a house or paying off student loans.

PocketGuard is available for free, but there is also a premium subscription that offers additional features, such as the ability to export your data to Excel and the ability to use PocketGuard on multiple devices.

EveryDollar

EveryDollar is a free budgeting app that uses the zero-based budgeting method. It’s similar to YNAB, but it’s less expensive and has a simpler interface. EveryDollar is a good option for people who are new to budgeting or who want a budget app that’s easy to use.

Honeydue

Honeydue is a budgeting app for couples. It allows you to share your budget with your partner and track your spending together.

Wally

Wally is a budgeting app that’s available in over 100 countries. It’s a good option for people who travel frequently or who need a budget app that works in multiple currencies.

Fudget

Fudget is a budgeting app that doesn’t require you to link your bank accounts. This makes it a good option for people who are concerned about privacy or who don’t want to give their bank account information to a third-party app.

The best budgeting app for you will depend on your individual needs and preferences. Consider the features that are important to you, such as whether you want an app that syncs with your bank accounts, offers bill pay reminders, or helps you track your spending in multiple currencies. Once you’ve considered your needs, you can start comparing different budgeting apps to find the one that’s right for you.