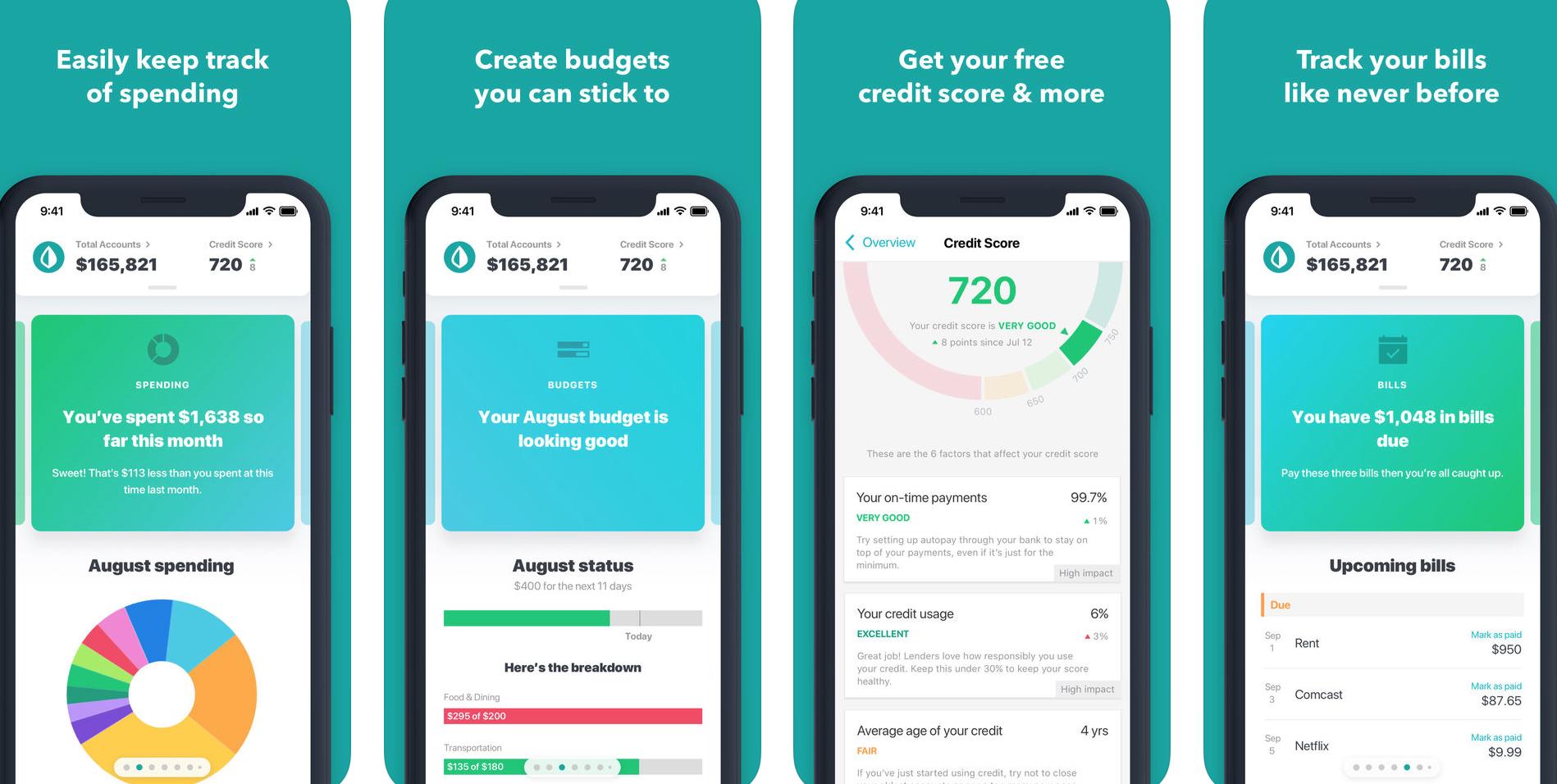

Mint is a free budgeting app that syncs with your bank accounts and credit cards to track your spending. It also offers bill pay reminders, credit score monitoring, and investment tracking.

Here are some key features and aspects of the Mint:

- Account Aggregation: By connecting your various bank accounts, credit cards, loans, and investments to Mint, you can view all your financial information in one place. This centralized view makes it easier to get a comprehensive overview of your financial health.

- Budgeting Tools: Mint allows users to create personalized budgets based on their spending habits. The app automatically categorizes transactions and lets users see where their money is going every month.

- Bill Tracking and Reminders: The app tracks your bills and sends reminders so you can avoid late fees.

- Credit Score Monitoring: Mint provides free credit score checks, along with insights into the factors influencing your score.

- Financial Goals: Users can set up savings goals for things like emergencies, vacations, or large purchases, and Mint will help track progress towards those goals.

- Security: Mint uses bank-level encryption and security practices to ensure that users’ data is safe. Additionally, while the app provides a read-only view of your financial data, meaning no transactions can be made from within the app itself.

- Cost: The core features of Mint were free, which made it a popular choice among those looking for a comprehensive budgeting tool without a subscription fee. However, Mint did display advertisements and offers based on users’ financial data.

- User Experience: Mint has a user-friendly interface, with easy-to-understand graphs and charts that provide clear insights into spending patterns, net worth, and more.

Overall, Mint is a great free budgeting app that offers a comprehensive set of features. It’s easy to use, syncs with multiple accounts, and offers bill pay reminders and credit score monitoring.

It can be slow to sync and can be intrusive with ads. If you’re looking for a free budgeting app with all the features you need, Mint is a great option. However, if you’re looking for an app with more advanced features or the ability to share your budget with others, you may want to consider a paid budgeting app like YNAB.